location:Willbet.com Play Online Casino Games in EURO and Win Real money > Lucky willbet slot

【melbet review】Star Entertainment receives backing amid imminent Queen's Wharf sale

Willbet.com Play Online Casino Games in EURO and Win Real money2025-04-29 22:54:29【Lucky willbet slot】1view

infoThe Star Entertainment Group has reportedly received financial assistance as it moves closer to offl melbet review

The move, involving Star offloading its stake in the development to to its Hong Kong-based partners, Chow Tai Fook and Far East Consortium, is an attempt to prevent the casino operator from facing bankruptcy.

The move, involving Star offloading its stake in the development to to its Hong Kong-based partners, Chow Tai Fook and Far East Consortium, is an attempt to prevent the casino operator from facing bankruptcy.

The proposed deal would reportedly involve a A$50m capital injection, which could help Star avoid going into administration.

Chow Tai Fook and Far East Consortium, which each own a 25% stake in Queen’s Wharf, have expressed interest in taking full control of the casino.

In addition to their stake in the project, both firms are also investors in Star itself, which has been struggling financially due to mounting debts and regulatory issues.

The casino operator’s financial troubles have led it to seek A$100m in short-term financing, with A$60m expected from the recent sale of its Sydney events centre, pending approval from the New South Wales government.

The Star recently entered a trading halt after failing to publish its half-year financial results, citing the need to first secure a refinancing agreement.

The company stated that it would only release its results once it had secured refinancing to cover its corporate debt and ensure liquidity.

As of 31 December 2024, Star reported having only A$78m in available cash, adding urgency to its financial restructuring efforts. As of last week, it reportedly only had enough cash to last another week.

Despite the dire situation, The Star had previously rejected multiple offers of assistance, including proposals from its Hong Kong partners and US-based Oaktree Capital.

However, The Australianreports that Queensland coal baron Chris Wallin has offered Star a A$200m bridging loan to keep it afloat until the Queen’s Wharf sale to Far East Consortium is finalised, suggesting that the deal is close to completion.

Queen’s Wharf project falls apart

The Queen’s Wharf Brisbane was first proposed in 2015 as part of the Queensland government’s efforts to revitalize Brisbane’s central business district and riverfront.

The development was designed to feature a world-class integrated resort, including a luxury casino, high-end hotels, residential apartments, retail spaces, and entertainment venues.

Star secured the license for the Queen’s Wharf project in partnership with Chow Tai Fook and Far East Consortium.

The trio formed a consortium called Destination Brisbane Consortium, with Star Entertainment holding a 50% stake, while Chow Tai Fook and Far East Consortium each held 25%.

The total cost of the project was estimated at A$3.6bn ($2.3bn), with Star committing significant capital towards its development.

However, according to company statements last September, Star Entertainment’s new CEO, Steve McCann, was looking to write down the value of Queen’s Wharf by A$1.4bn.

The project has been plagued by delays. Originally scheduled to open in 2022, the completion date has been pushed back multiple times due to construction setbacks, regulatory scrutiny, and financial challenges.

It finally began opening in August of last year.

One of the major controversies surrounding the project involves Far East Consortium’s involvement. The firm has faced scrutiny over its business practices and financial transparency.

Additionally, concerns have been raised about the influence of foreign entities in Australia’s gaming sector, particularly with Chow Tai Fook, which has historical ties to Macau’s junket operators.

Despite these challenges, the Queensland government has remained committed to the Queen’s Wharf development, citing its potential to generate billions in tourism revenue and create thousands of jobs.

However, The Star’s financial turmoil has put the project’s future in question. If Star sells its stake to its Hong Kong partners, it would mark a significant shift in the ownership structure of one of Australia’s largest casino developments.

praise!(4)

Related articles

- Julmys på Spelklubben

- FAST FACTS: NBA Leaders In Points, Rebounds, Steals

- Travis Kelce Odds: When Will The NFL Star Retire?

- Arkansas bill filed to allow licensed online casinos

- Free Spins med olika fördelar

- GamCare’s Helpline Supports Over 55,000 Contacts as Demand Rises by 25%

- FY24: Evoke shares drop 18% despite revenue recovery

- JMP: DraftKings 'rooting for' positive prediction markets ruling from CFTC

- En inkörsport till spel om pengar

- Robinhood hit with subpoena in Massachusetts over betting markets

hot

comment

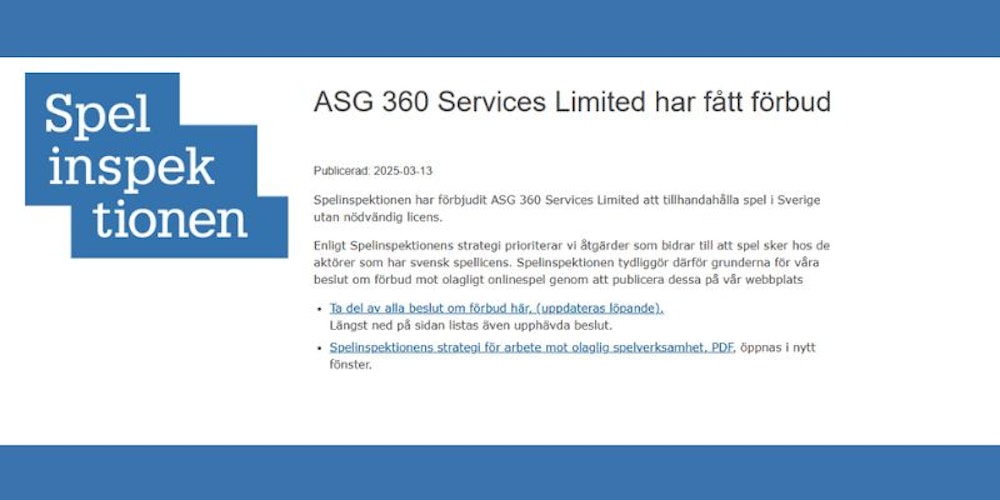

Svartlistat: ASG 360, spelbolaget bakom GG.Bet

4 ways to spot an online casino’s red flags

Landmark Finland gambling law begins parliamentary process

Get Set for March Madness with The Pick 'Em Game at Sports Millions (up to 1500x Return)

Games Global i stort avtal med Ubisoft

Maryland governor loses bid to double sports betting tax rate

More than 300 arrested in Interpol crackdown on iGaming cybercrime

Underdog valued at $1.2bn after latest funding round